Buying a home in 2017? Prepare for battle

If you’re thinking about buying a home this year, arm yourself with cash -- and gird for an aggressive, nasty and stressful battle in many markets. You may also need to up the price you’ll actually pay well beyond your planned budget, according to a survey by website Owners.com.

“Home buying is about substantive economics, but it’s also got an element of ‘animal spirits,’” said its President Steve Udelson. “In some of the hottest markets, we’ve seen a double-digit run-up in prices.”

The website surveyed 1,289 prospective buyers nationwide, and its findings suggested that most prospective homeowners already had their feet in the starting blocks for the spring selling season. More than half were willing to go beyond their budget -- by an average of nearly $38,000 -- to get the property they desired.

And like most competitive athletes, they were hopeful as well as scared. Not surprisingly, about 60 percent of those surveyed feared:

- Bidding wars driving up the price of their dream home

- Losing the “earnest money” they put down when they signed a contract

- Becoming “house poor,” that is, unable to afford amenities like a meal out in order to make the mortgage payment

Even though the survey was done by an online real estate broker, the National Association of Realtors (NAR) probably wouldn’t disagree. The NAR’s most recent survey of “days on market” shows that the time it takes to sell a house has fallen by 28 percent, from 69 days in January 2015 to 50 days in January 2017, the last month figures were available (see following chart). Since the real estate market is seasonal, and usually improves in spring and summer, a comparison by month offers the best analysis.

The NAR chart indicates that the days on market figure could drop to the low 30 percent level by midyear, as it did in 2016. In other words, the average home for sale across the country will be on the market for about a month or less, depending on location. That encourages buyers to put down a bid right away -- or lose it.

The housing bubble, seen during the early years of this century, burst in 2007 and 2008, leaving a huge glut of homes on the market, along with a large number of foreclosures. But that has changed, and the market has seen a steady run-up of home prices in recent years, while builders of new homes haven’t kept up.

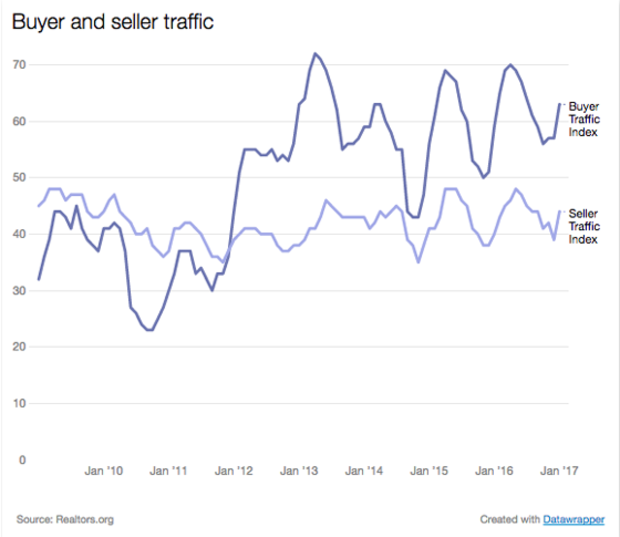

NAR Chief Economist Lawrence Yun said the rising prices for housing is simple: lack of supply. “There’s not enough inventory out there to satisfy people,” he said. “Buyer traffic is clearly outpacing seller traffic [see following chart]. That’s because there’s been an underproduction of new homes over the past decade.”

Yun expects prices to rise 4 percent in 2017, roughly the same as last year. The reason he doesn’t expect a huge spike -- at least right now -- is that a gradual increase in mortgage rates due to Federal Reserve interest rate hikes will “put a damper on it.” Plus, the housing market has already seen a significant price rise.

Bicoastal prices, which are always tight, are on the rise, but even in the middle of the country, cities like Kansas City and St. Louis, Missouri, are also surging. The only declines on the horizon are in states such as Alaska, Louisiana and North Dakota, where job losses in the oil market have caused housing prices to fall.

Also, most of the homes for sale in New England aren’t seeing multiple bids, with the exception of Boston, which is still a hot market, Yun said.

Udelson, who said the “hot market” cuts both ways, sounded a warning bell for what might happen in the future. In particular, he pointed to overextended areas of both coasts where only 30 percent to 40 percent of the prospective home buyers had the median income that could finance the mortgage for an average-price home.

“The wider spreads in prices are being set by the marginal buyers,” said Udelson, meaning that those who are able to buy move the prices up, and everyone else tries to follow along.

Auctions are becoming more of the norm, where the home ends up selling for far more than the listing price because prospective buyers bid it up. “You may be involved in one and not even know it,” he warned. “It reminds me of what we’ve seen in past run-ups where prices weren’t fully supported by values.”

The Owners.com survey concluded that nearly three-quarters of all potential buyers expect “stress in the home buying process.” That comes as no surprise.